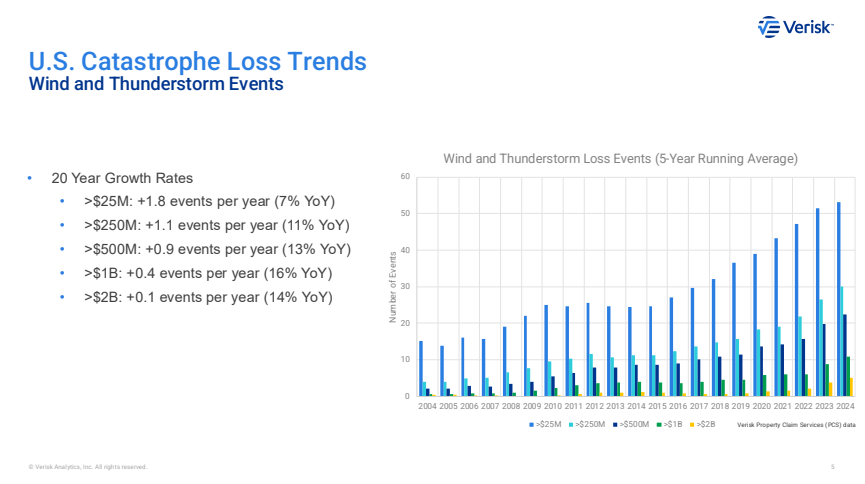

Severe Weather Claim Payouts Have Tripled in the Last 10 Years

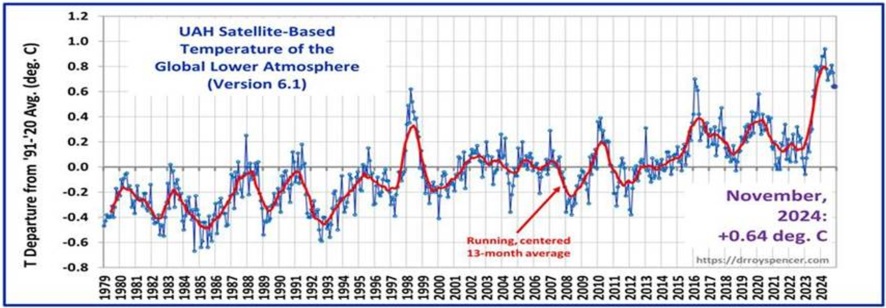

Higher intensity and frequency of fires, floods, hurricanes, tornados, and landslides are increasing risk across every major insurance market.

Carriers and regulators need better tools to understand true exposure and statewide payout patterns over time.

What Can Be Done?

A Proposal for State Insurance Commissions (SICs)

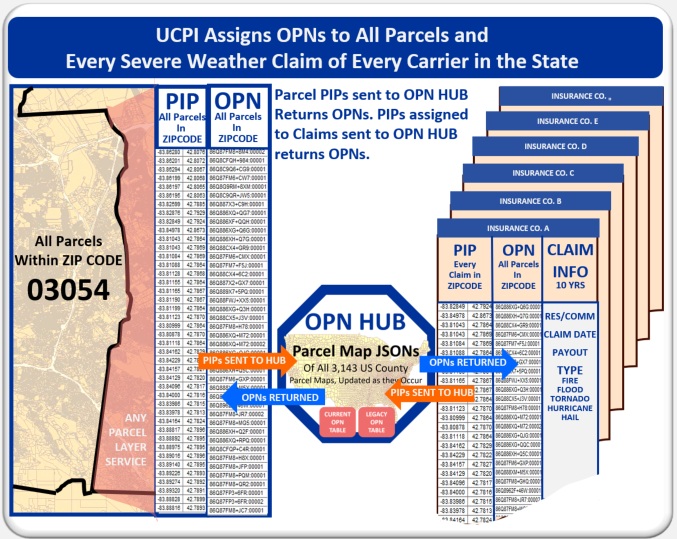

Each State Insurance Commission requests that every property insurance carrier share parcel-level severe weather claim history for the past 10 years.

In return, carriers receive access to PropertyFAX™ —

The CarFAX® for Real Estate

A unified, cross-carrier compilation of severe weather claims, enabling accurate, transparent underwriting across all parcels in the state.

This shifts underwriting from siloed carrier-specific data to true statewide risk intelligence.

Why It Matters

PropertyFAX enables:

- Severe Weather Underwriting based on total payouts over time, not a single carrier’s history

- Cross-carrier visibility for all parcels

- Improved risk scoring from historic loss patterns

- Better pricing and fairer consumer protection

How It Works

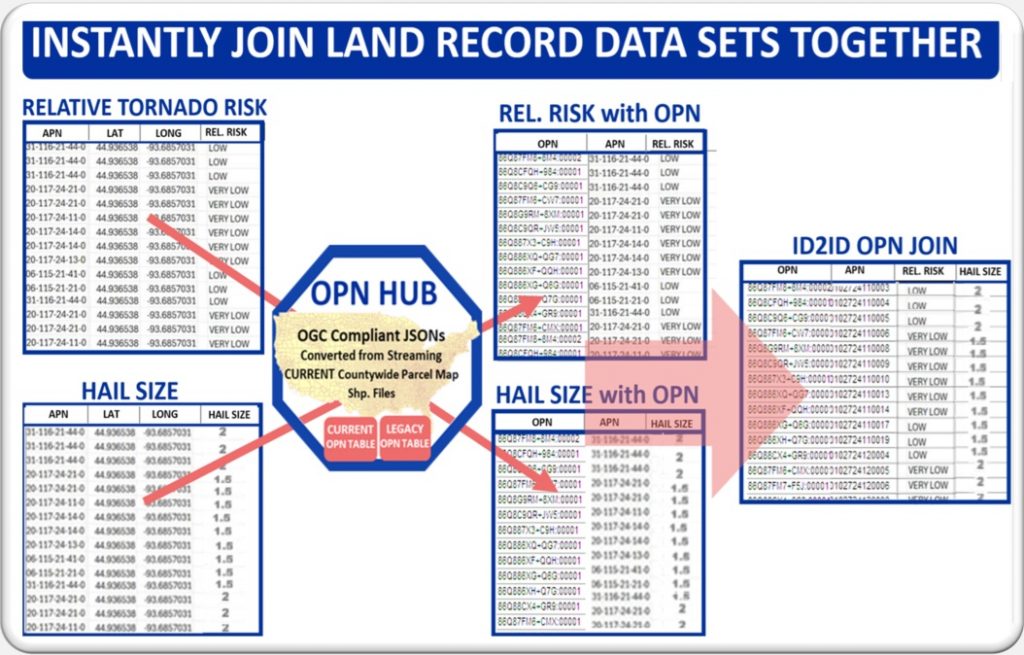

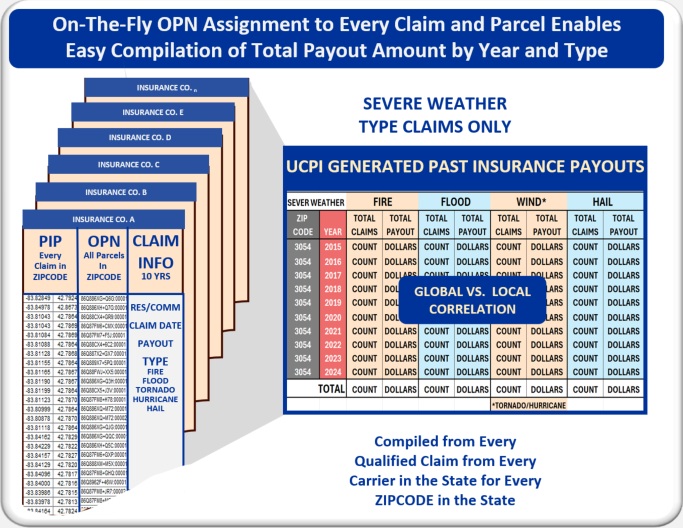

The Universal Common Parcel Index (UCPI) assigns a unique Open Parcel Number (OPN) to every parcel boundary and to every insurance claim associated with a location.

Workflow:

- Point-in-Parcel (PIP) coordinates, parcel boundaries, and claim attributes are transmitted securely to the OPN Hub.

- The OPN Hub matches each claim to its precise parcel boundary.

- At the SIC’s request, carriers supply the last 10 years of severe weather claim data, including:

- PIP (latitude/longitude) or Situs address

- Claim date

- Claim amount

- Severe weather claim type

- Once OPNs are assigned, OPN-to-OPN joins instantly generate statewide analytics:

- Total payouts by year

- By ZIP code, county, or region

- By claim type or severity

This creates the first-ever complete, unified loss history across all carriers.

PropertyFAX™ — The CarFAX for Real Estate

A new standard for property intelligence, underwriting accuracy, and consumer transparency.

Benefits

- Inclusionary Premium Underwriting

Evaluate risk using complete, consensus claim history across all carriers. - Buyer Awareness

Homebuyers can see severe weather claim history for a property. - Fraud Reduction

Cross-carrier visibility exposes duplicate, inflated, or suspicious claims. - Cost Reduction

Better information → more accurate underwriting → fairer rates. - Risk Reduction

Regulators, carriers, and analytics groups make decisions using consistent, multi-source data.

Conclusion

- Significant impact on underwriting excellence and risk modeling.

- No impact on legacy carrier systems — OPN Hub operates outside the enterprise.

- OPN USA will partner with insurance advisory organizations or integrate with any state-designated advisory service.

- Severe weather analytics companies gain the ability to compare predicted vs. historic effects using real payout trends.